mississippi state income tax 2021

The income tax table has changed. 80-100 Individual Income Tax Instructions.

Should You Move To A State With No Income Tax Forbes Advisor

Find your income exemptions.

. Tax Year 2018 First 1000 0 and the next 4000 3 Tax Year 2019 First 2000 0 and the next 3000 3 Tax Year 2020 First 3000 0 and the next 2000 3 Tax Year 2021 First 4000 0 and the next 1000 3 Tax Year 2022 First 5000 0. 80-107 IncomeWithholding Tax Schedule. Where do I send my Mississippi state income tax return.

House tries to revive it. If you make 70000 a year living in the region of Mississippi USA you will be taxed 11472. Select Popular Legal Forms Packages of Any Category.

Mississippis Individual Income Tax Rate Schedule Tax Year 2021 All Filers 3 4000 4 5000. Income Tax Rates Taxable Income Tax Rate First 4000 0 Next 1000 3 Next 5000 4 Excess of 10000 5 If you have any questions contact Withholding Tax at the address below. Mississippi Tax Brackets for Tax Year 2021.

The income tax in the Magnolia State is based on four tax brackets with rates of 0 3 4 and 5. Tax Filing Is Simple And Free For Those Who Qualify With TurboTax Free Edition. Title 27 Chapter 13 Mississippi Code Annotated 27-13-1.

For single taxpayers your gross income must be more than 8300 plus 1500 for each dependent. 71-661 Installment Agreement. Your average tax rate is 1198 and your marginal tax rate is 22.

80-108 Itemized Deductions Schedule. Find your pretax deductions including 401K flexible account contributions. If you are receiving a refund.

Department of Revenue - State Tax Forms. E-File Directly to the IRS State. Preservation tax incentives program which provides for a state income tax credit equal to 25 of the qualified expenses of rehabilitating historic structures used for residential or business purposes.

Properties do not need to be income-producing to qualify for the state tax credit. Because the income threshold for the top bracket is quite low 10000 most taxpayers will pay the top rate for the majority of their income. Mississippi State Taxes 2021.

Senate kills Mississippi income tax elimination. Taxpayer Access Point TAP Online access to your tax account is available through TAP. The state income tax table can be found inside the Mississippi Form 80-105 instructions booklet.

The following is a list of those companies intending to provide on-line electronic filing of Mississippi Individual Income Tax Returns for tax year 2021. Mississippi Income Taxes. Pay Period 05 2021.

Detailed Mississippi state income tax rates and brackets are available on this page. 80-155 Net Operating Loss Schedule. Ad Free 2021 Federal Tax Return.

Rehabilitations of owner-occupied residences are eligible. TaxFormFinder provides printable PDF copies of 37 current Mississippi income tax forms. For all other Income Tax Returns.

The default exemption based on marital status has changed to zero 0 if the employee has not filed a State W-4 form. Ad Real Estate Landlord Tenant Estate Planning Power of Attorney Affidavits and More. The standard deduction for No W-4 filed has changed from 4600 to 2300.

For Income Tax Refunds. 80-105 Resident Return. Printable Mississippi state tax forms for the 2021 tax year will be based on income earned between January 1 2021 through December 31 2021.

Ad See If You Qualify To File For Free With TurboTax Free Edition. All other income tax returns. 80-106 IndividualFiduciary Income Tax Voucher.

The Mississippi income tax rate for tax year 2021 is progressive from a low of 0 to a high of 5. Any income over 10000 would be taxes at the highest rate of 5. The list below details the localities in Mississippi with differing Sales Tax Rates click on the location to access a supporting Sales Tax Calculator.

Check the 2021 Mississippi state tax rate and the rules to calculate state income tax. A downloadable PDF list of all available Individual Income Tax Forms. Married taxpayers must make more than 16600 plus 1500 for each qualifying dependent.

By Bobby Harrison March 22 2021. Medical marijuana and taxes the hallmark 2021 legislative efforts are likely dead. Mississippi allows returns to be filed on-line using your home computer and an Electronic Transmitter ServiceOn-Line Service Provider.

Am I considered to have filed on time if. The current tax year is 2021 and most states will release updated tax forms between January and April of 2022. The list starts with those companies that are offering free.

The tax brackets are the same for all filing statuses. Calculate your state income tax step by step. By Geoff Pender March 16 2021.

All Major Categories Covered. As you can see your income in Mississippi is taxed at different rates within the given tax brackets. 80-115 Declaration for E-File.

The income tax withholding formula for the State of Mississippi includes the following changes. Find your gross income. Detailed Mississippi state income tax rates and brackets are available on this page.

The Mississippi income tax has three tax brackets with a maximum marginal income tax of 500 as of 2022. This marginal tax rate means that. 2021 Mississippi State Sales Tax Rates.

Mississippi has a state income tax that ranges between 3 and 5 which is administered by the Mississippi Department of Revenue.

Will Michigan Lower Its Tax Rates Here S How We Compare To Other States Mlive Com

State Income Tax Rates Highest Lowest 2021 Changes

Calculate Income Tax In Excel How To Calculate Income Tax In Excel

List Of State Income Tax Deadlines For 2022

State Corporate Income Tax Rates And Brackets Tax Foundation

States With No Income Tax H R Block

Lowest Highest Taxed States H R Block Blog

Mississippi State Tax Refund Ms State Tax Brackets Taxact Blog

How To Calculate Income Tax In Excel

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

How To Calculate Income Tax In Excel

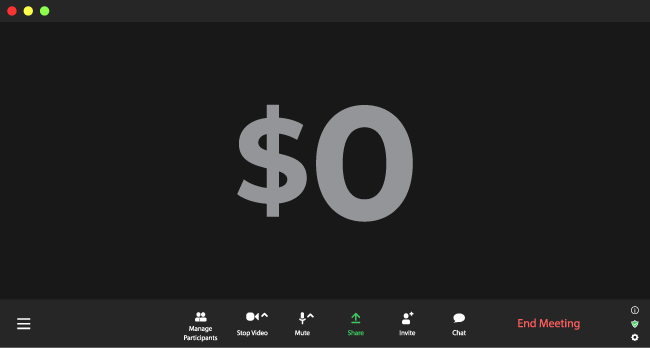

Zoom Pays 0 In Federal Income Taxes On Pandemic Profits Itep

How Do State And Local Individual Income Taxes Work Tax Policy Center

When Are Taxes Due In 2022 Forbes Advisor

Free Tax Estimate Excel Spreadsheet For 2019 2020 2021 Download

Excel Formula Income Tax Bracket Calculation Exceljet

Calculate Income Tax In Excel How To Calculate Income Tax In Excel